Yesterday the government of Puerto Rico asked for bankruptcy relief in federal court. Puerto Rico owes about $70 billion to bondholders and about $50 billion in pension obligations. Before asking for protection the government offered to pay back some of the debt (50% according to some news reports) but bondholders refused. Bondholders will now fight in court to recover as much of what is owed as possible while the government and a federal oversight board will try to lower this amount. What can we expect to happen?

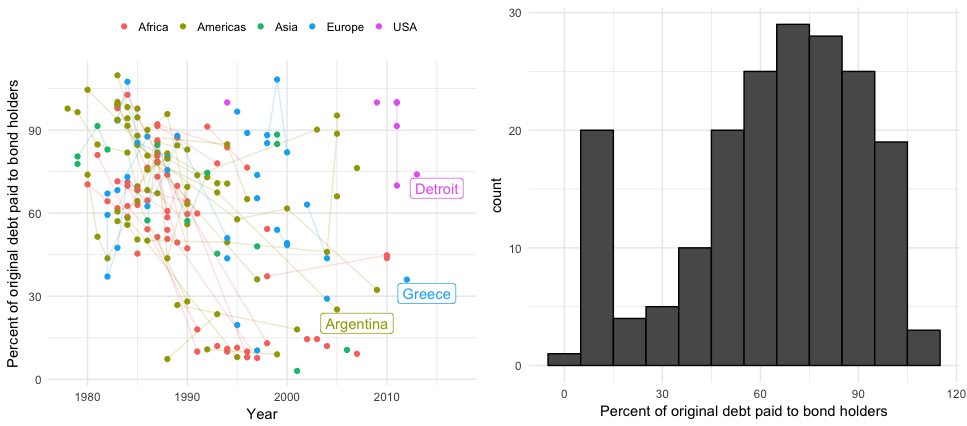

A case like this is unprecedented, but there are plenty of data on restructurings. An op-ed by Juan Lara pointed me to this blog post describing data on 180 debt restructurings. I am not sure how informative these data are with regards to Puerto Rico, but the plot below sheds some light into the variability of previous restructurings. Colors represent regions of the world and the lines join points from the same country. I added data from US cases shown in this paper.

The cluster of points you see below the 30% mark appear to be cases involving particularly poor countries: Albania, Argentina, Bolivia, Ethiopia, Bosnia and Herzegovina, Guinea, Guyana, Honduras, Cameroon, Iraq, Congo, Rep., Costa Rica, Mauritania, Sao Tome and Principe, Mozambique, Senegal, Nicaragua, Niger, Serbia and Montenegro, Sierra Leone, Tanzania, Togo, Uganda, Yemen, and Republic of Zambia. Note also these restructurings happened after 1990.